Don’t VCs and watertech investments mix like oil and water?

Yesterday's overlooked crisis surfacing today

Imagine a world made of 71% of water where WaterTech investments represent less than 1% of climate investments. Yeah, that’s the world we’re living in.

It leaks water everywhere… While we often perceive the water challenges as primarily being a drinking water one, its significance extends far beyond that. Water is an essential element of our society, permeating everything it sustains, acting as society's lifeblood. It's fundamental to every aspect of our lives : from food to clothing to furniture. Yet, 92% of it goes unseen to us : on a daily basis, the average person consumes 137L of domestic water consumption, uses 167L for industrial products and 3496L for food production.

Problem is, once perceived as abundant and freely available, water is now recognized as a finite and contested asset. And, its journey is still very complex. In our data-driven society, we could think of water as being monitored in real time. Spoiler alert: it’s not. Even if some methods do exist, we can’t have a precise measure of the amount of water we’re using and where it comes from in real time, annual monitoring remaining the standard.

In this context, water doesn't receive the recognition it deserves in our society. Investments fall far short of the critical importance it holds. Perhaps it's time for venture capitalists to dive into uncharted waters and tackle the challenges we're facing today in Watertech.

Houston, we’re in hot water. 👨🚀

Water is the new blue gold.

We've never experienced a water crisis like the one we're facing now, says the UN. Achieving the United Nations Sustainable Development Goal 6, aiming for universal access to clean water and sanitation by 2030, seems increasingly elusive.

Global freshwater demand is projected to outstrip supply by 40% by 2030, impacting approximately 3.9 billion people. This looming water stress presents a substantial risk to businesses, estimates suggesting that by 2050, 66% of major global companies will face assets vulnerable to climate change, with water stress posing the greatest threat. In France, experts anticipate a decline in water availability ranging from -10% to -40% in the coming decades, aggravated by more frequent drought episodes.

Don’t mess with the water cycle, period. - Insights from Charlène Descollongue, Co-founder of the Association for Regenerative Hydrology

We are witnessing an increase in extreme hydrological phenomena, as evidenced by the winter of 2022-2023 marked by a record-setting 32 consecutive rainless days, while groundwater levels remain insufficiently recharged.

Charlène Descollongue, Co-founder of the Association for Regenerative Hydrology

Think of Charlène as a star of water preservation: she has authored reference books on the subject, founded an association on generative hydrology, and is the expert invited everywhere in Europe to speak about it.

9 minutes can be precious, so here are the key takeaways:

We have significantly disrupted the water cycle even before affecting the climate. It's often overlooked that the climate and water cycles are closely linked.

Priority should be given to slowing down the water cycle, accelerated by human actions, by allowing water to infiltrate into the soil and reconnecting natural green and blue networks, emphasizing the synergy between water, soil, and trees.

Technology can aid in various aspects, such as enhancing our understanding of water pollution, characterizing wetlands, or developing new depollution techniques, underlining the principle that better knowledge leads to better protection.

So why are VCs NOT caring about water ? 🤔

Water tech 101: it’s far beyond water filtration.

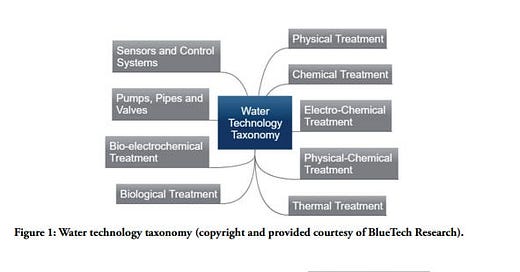

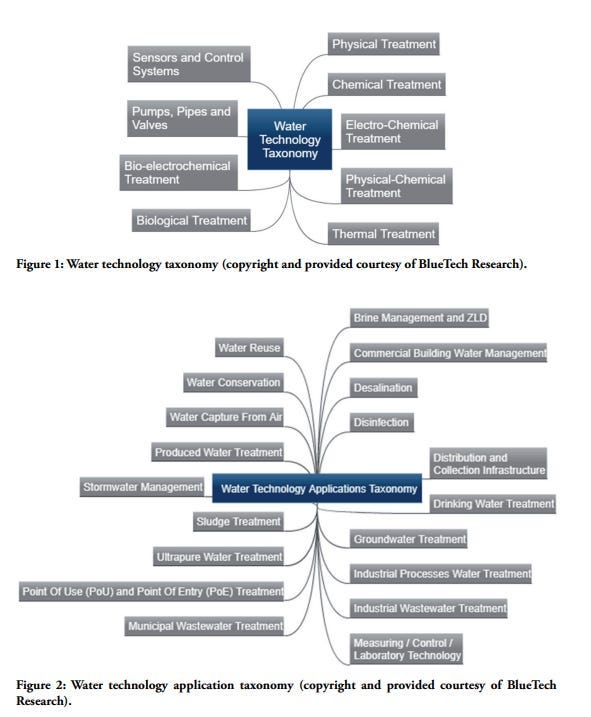

You can easily feel like you're in deep water because water technologies encompass a wide array of technologies: from pumps, pipes, and valves, to sensors and control systems, and even bioelectrochemical treatment. And that’s not all - there are also numerous applications, including water reuse, water conservation, and water capture from the air.

But don’t panic, we’ve got a mapping for you from BlueTech Research (a must-go source to get a grasp of what water technology entails - see Figure 1).

Source : Extract from Paul O’Callaghan, 2020, Dynamics of Water Innovation Insights into the rate of adoption, diffusion and success of innovative water technologies globally, p.12.

High stakes looooooong returns. - Insights from Paul O’Callaghan, Founder & CEO of BlueTech Research and Brave Blue World Foundation

Yet, what truly distinguishes this sector is the prolonged process of developing and adopting water technologies, often spanning more than a decade. Paul O'Callaghan's in his article (Dynamics of Water Innovation : Insights into the rate of adoption, diffusion and success of innovative water technologies globally, 2020) introduces a comprehensive model for understanding the adoption of these technologies (see Figure 2). The WaTA model provides practical criteria for informed decision-making by innovators and investors, validated through extensive testing on hundreds of water technologies and supported by six case studies.

One key insight from this model is the considerable time, ranging from 17 to 24 years, required for a technology to transition from early innovation to widespread adoption. Factors such as the fragmented global water market, extended replacement cycles for existing technologies, and market growth linked to population increases and regulatory changes all contribute to the slow diffusion of new technologies and limited disruption within the water sector.

While some factors may hasten technology development, their impact remains unexplored. However, it's evident that technologies facing prolonged development timelines risk never gaining market traction. This unique characteristic of water companies, where they persist rather than outright fail, underscores the challenge for venture capitalists seeking rapid returns within the typical 7 to 10-year timeframe. Additionally, only a small fraction, about 9%, of water innovations successfully navigate through the chasm.

The fairy world of 🦁 🐴 🦄

Another noteworthy framework presented by Paul assesses the market impact of water technologies, categorizing them into lions, horses, and unicorns based on the total number of reference plants, the total number of countries where the technology is adopted, and total annual market value. Technologies reaching Level 1 (i.e. unicorns) impact typically take 21 years from initial installation, with potential acceleration to this level within 10 years after reaching Level 2 (i.e. horses). This implies that while investment in water technology offers opportunities, significant returns may not materialize as swiftly as in other sectors. Notably, today there's only one Level 1, the US startup Gradient (raised $392.4M, from BoltRock Holdings, Centaurus Capital LP, Warburg Pincus, SLB, WAVE Equity Partners, Cranberry Capital).

Cocktail ingredients for a water investment success :

Innovations can be driven by value, improving the status quo, or driven by needs, directly addressing a crisis. The latter tend to outperform radically, traversing the adoption curve twice as fast. In essence, if you seek a quicker return, you should prioritize innovations driven by needs.

There are supporting innovations, radical feature innovations, and discontinuous innovations, each following a specific path to the market and requiring different development strategies. The last two types of innovation may be more appealing to venture capitalists. In fact, we must move beyond simply improving existing technologies or systems. Instead, we should embrace new technologies like Artificial Intelligence, the Internet of Things (IoT), and leverage Big Data for valuable insights. Note that this presents opportunities for both hardware and software solutions.

The watertech market is highly fragmented, even at the country level. Some technologies are quickly and strongly adopted in specific geographies due to pressing needs, while others may never be adopted in certain regions. However, there are also instances of homogeneous needs that can lead to widespread adoption. Seeking high returns, venture capitalists should prioritize homogeneous needs. Of course, this doesn't mean that localized needs should be disregarded, but they may not necessarily be the primary target for venture capitalists.

Higher velocity across the model stages correlates with an increased probability of success for the technology, and vice versa. Especially in this market, venture capitalists should take a close look at the velocity when assessing a startup.

Competition can potentially foster faster adoption of new technologies.Nothing very new here !

If after all this, you still haven't gone to fetch Paul O'Callaghan's article on the subject, here's the link : Dynamics of Water Innovation : Insights into the rate of adoption, diffusion and success of innovative water technologies globally, 2020

In deep water : governance troubles GTM.

So, now that you understand that investing in water technologies might be a bit challenging, let me add another layer to it. In fact, understanding the complexities of the water sector requires navigating through a multitude of actors and laws at various levels—French, European, and international. The evolution of water policy in France has been shaped by key legislative milestones, starting from the 1960s, with laws addressing water regulation and pollution control.

At first, there was a club of 4 :

The 1964 law concerned the regulation and distribution of water and the fight against pollution, established a decentralized water policy, with the creation of water agencies and basin committees.

The 1992 law elevated water to the status of "Common Heritage of the Nation" and provided for the establishment of a Master Plan for the Development and Management of Water (SDAGE) for each basin, accompanied by the creation of a Water Directorate.

The 2000 European Directive (DCE) setted the objective of achieving a good status of water across the European Union by 2027.

The 2006 law (LEMA) introduced the principle of the right to water for all and provided for the consideration of climate change in all decisions related to water management.

And then it turned into a mille-feuille.

A number of texts followed such as the Grenelle Environmental Law (2009), the Law for the Recovery of Biodiversity, Nature, and Landscapes (2016), the Climate and Resilience Law (2021), the decree of June 2021 aiming to improve the management of crisis situations related to drought and to regulate water withdrawal permits.

Could we add more complexity please? Yep, in parallel with these legislative frameworks, the government unveiled a Water Plan in March 2023, aiming to achieve ambitious targets for water conservation and wastewater reuse by 2030. The plan focuses on accelerating water efficiency, combating leaks, preventing pollution, improving water management governance, and implementing appropriate pricing strategies. It encourages all economic sectors to adopt water-efficient practices, with funding allocated to support agricultural and industrial initiatives aimed at reducing water consumption.

And here we’re only talking about French regulations. Let’s add a bit of European Union spice! EU regulatory revisions are underway, particularly concerning municipal waste utilities and wastewater treatment regulations. These efforts, including the adoption of European sustainability reporting standards, aim to enhance transparency and accountability regarding water usage and footprints across companies and countries.

Hope you’re still reading because we have not finished yet. All these laws came with the creation of different entities, such as water agencies, basin committees, or the Water Directorate. Therefore, the French water management model, once considered exemplary, is now criticized, especially after recent drought episodes revealed challenges in ensuring sustainable access to water for all uses and managing withdrawals compatible with resource renewal rates. A report by the Court of Auditors in July 2023 highlighted the complexity of water policy governance, noting a mix of historical decentralization and centralization tendencies. Actions taken at geographically inappropriate scales, along with a lack of performance indicators and transparency regarding public financing of water policy, were also noted.

Water, the next democracy’s problem.

Water is everyone's concern, making it a major issue for our democracies. Yet, today, a rather fragmented approach persists, and we're already witnessing the initial risks with the financialization of water. This trend, observed in regions like Australia where water quotas are tradable on stock markets, can exacerbate disparities and impact vulnerable communities and essential sectors like agriculture. Although Europe has resisted extensive financialization, recent initiatives such as water futures markets in California highlight the trend towards commodifying water. Consequently, there's growing concern about preserving water as a public good, ensuring equitable access, and promoting sustainable management practices.

In today’s world, engaging communities remains essential for effective water management, necessitating holistic strategies that foster collaboration among all stakeholders, including governments, engineering experts, diverse community interests, and citizens. However, achieving this cohesion is hindered by competing interests, disparate agendas among governmental bodies, and the pervasive influence of politics and diplomacy within the water sector.

Don't throw the baby out with the bath water. 🛁

Is water the new gold rush?

European VCs have significantly increased their investments in watertech startups, with funding reaching $300 million in 2022, doubling from the previous year. While this represents a small fraction of climate tech funding (around 1%), the upward trend indicates a growing recognition of the sector's potential for innovation and impact.

Also, there's a resurgence of interest among Limited Partners (LP) (Tom Ferguson, Burnt Island Ventures), as evidenced by swift fundraising by emerging companies (i.e. Daupler - $6M, Floodbase - $21.3M, StormSensor - $13.5M) and the involvement of prominent investors (i.e. DCVC, LowerCarbon Capital, Afore Capital, Collab Fund, Emerald Ventures, Pureterra Ventures).

More and more taking the plunge.

Collaboration among investors, particularly beyond the water sector, is crucial for maximizing the success of leading companies and expanding the sector's reach across diverse market segments. Despite the relatively few companies and funds currently dedicated to Watertech investments, there's a growing trend of new investment funds focusing on early and growth-stage water technologies, along with increased acquisition activities by larger publicly traded water companies (Anders Hallsby, Partner, Mazarine Ventures, Stuart Rudick, Founder & CEO, Water Innovation Accelerator). A growing number of Business Angels (even if still not sufficient Sam Dukan, CEO Diamidex) and large corporations are becoming interested in the subject, which could be beneficial for very early-stage startups struggling to secure funding from venture capital (VC) funds. In parallel, specialized events (e.g. Tech Tour Water tech, World Water Tech Innovation Summit) and non specialized events having increased focus on watertech issues (e.g. Change Now) showcase the sector's potential and opportunities for investment.

Countries are also actively investing in innovative solutions to tackle water challenges, such as wastewater reuse and infrastructure upgrades to reduce water loss. Remarkable funding mechanisms, exemplified by initiatives in Spain and Italy, are being adopted, with a notable emphasis on digitalization. This strategic focus underscores a concerted effort to leverage technology for efficient water management practices.

Water is getting cooler.

The American Water Works Association's (AWWA) assessment reveals a notable surge in overall optimism within the industry, with a rating of 5 out of 7. This reflects increased public awareness, increased funding, and a growing appreciation for the sector's importance. Additionally, the anticipation of positive revenue growth by two-thirds of industry players in 2023 underscores confidence in the sector's economic prospects.

A new era.

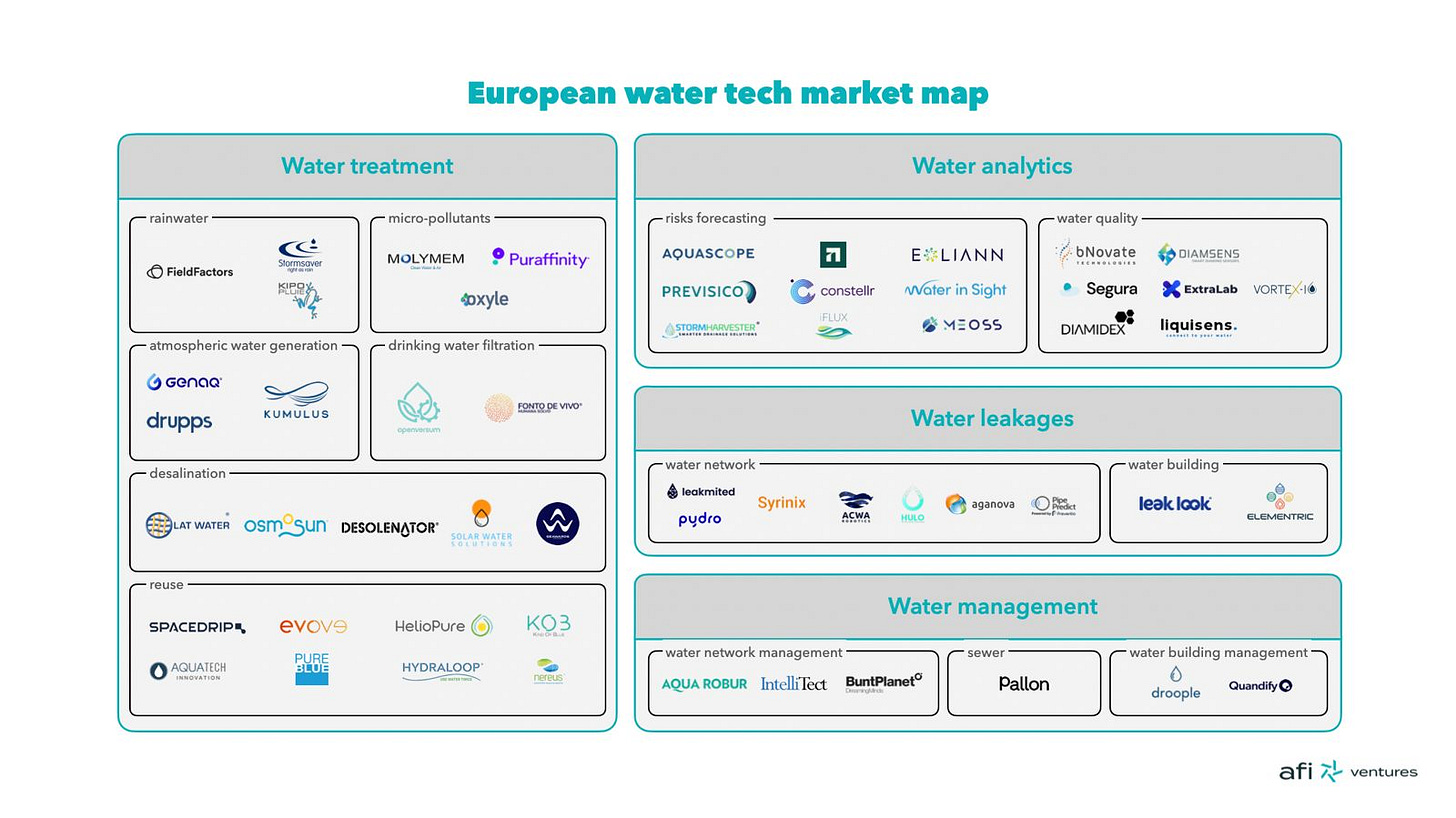

The water tech sector is sailing into a new era, powered by technology, which is transforming it into a venture opportunity—a shift less prominent in its previous hardware/infrastructure-centric state. It's crucial to acknowledge the limitations of models like Paul's, which rely on case studies dating back three decades, potentially failing to fully capture the current market trend towards increasingly tech-driven companies. Indeed, we are witnessing the emergence of a new generation of tech companies, spurred by social and environmental pressures, focusing on applications like analytics, leakage prevention, etc., which appear more VC-compatible cause less CAPEX-intensive.

Plenty of 🐟🐠 already in the ocean.

While there is a multitude of water technologies and diverse applications, as evidenced by Bluetech Research, defining the watertech market and its segments, as well as estimating their sizes, can be challenging.

To give you an overview of the market : in 2023, the global water and wastewater treatment market was estimated at approximately $301.7 billion in 2023 and is projected to reach $536.41 billion by 2030, with a compound annual growth rate (CAGR) of 7.5%.

To dive deeper into the ocean of startups, take a look at Dealroom, which aggregates over 600 watertech startups.

Conclusion : Get ready to catch the wave of watertech 🌊

At AFI Ventures, we don't see VC and watertech investments as incompatible like oil and water. Quite the opposite. If not venture capital firms, then who else will step up to break the cycle of inaction? It's high time we matched investments with the magnitude of the challenges we face and the essential role of water in our societies. Acknowledging investment barriers and practicing a touch more patience than usual is crucial. After all, we can't expect to solve yesterday's problems overnight. Embracing this reality is the initial stride toward aligning financial returns with tackling urgent global water challenges.

Please feel free to reach out if you want to discuss investment opportunities or if you're an entrepreneur looking to raise a pre-seed/seed round in the sector. 🌍🍃